Award-winning PDF software

Apply to join a nursery or other daycare organisation (ey2) - gov.uk

You will receive an Ousted email after applying for a DBS and a link to download or print the form. What your DBS involves Your DBS will require your personal information before you begin living or working in your home. Please read the policy that accompanies your DBS carefully, and follow the directions carefully before you send in your DBS. Who needs to apply What information you will need You'll need to provide a valid copy of your DBS. Ousted will send this information to Ousted at the email address it has on file for you. What your DBS involves Your DBS will identify your immediate family. You will need to submit a list of these members when you submit your form. If you have a child who has lived more than 30 days out of the school year in the last five years, you.

Ey2 form - fill out and sign printable pdf template | signnow

Free filmmaker. Get everything done with simple and easy-to-understand steps on how to set everything up. With an advanced editor and templates to create documents with, this one is for you if you are looking to get everything done with the little things. (48) Free OfficeMax! A powerful and easy-to-use document editor. With more features than other document editing apps (including document tabs and tabs per document), OfficeMax helps document editing become second nature. (44) Free Eyes & Mind. The perfect document editor for you to create professional and beautiful documents that will make you a productivity guru. With all features unlocked, eyes & mind will enable you to create documents with ease. (43) Free The Ease of use of all the app on Microsoft Surface tablet is excellent! The only problem that we think the user will encounter is that it takes to many steps to get something done. On top of.

Ey2 form - fill online, printable, fillable, blank | pdffiller

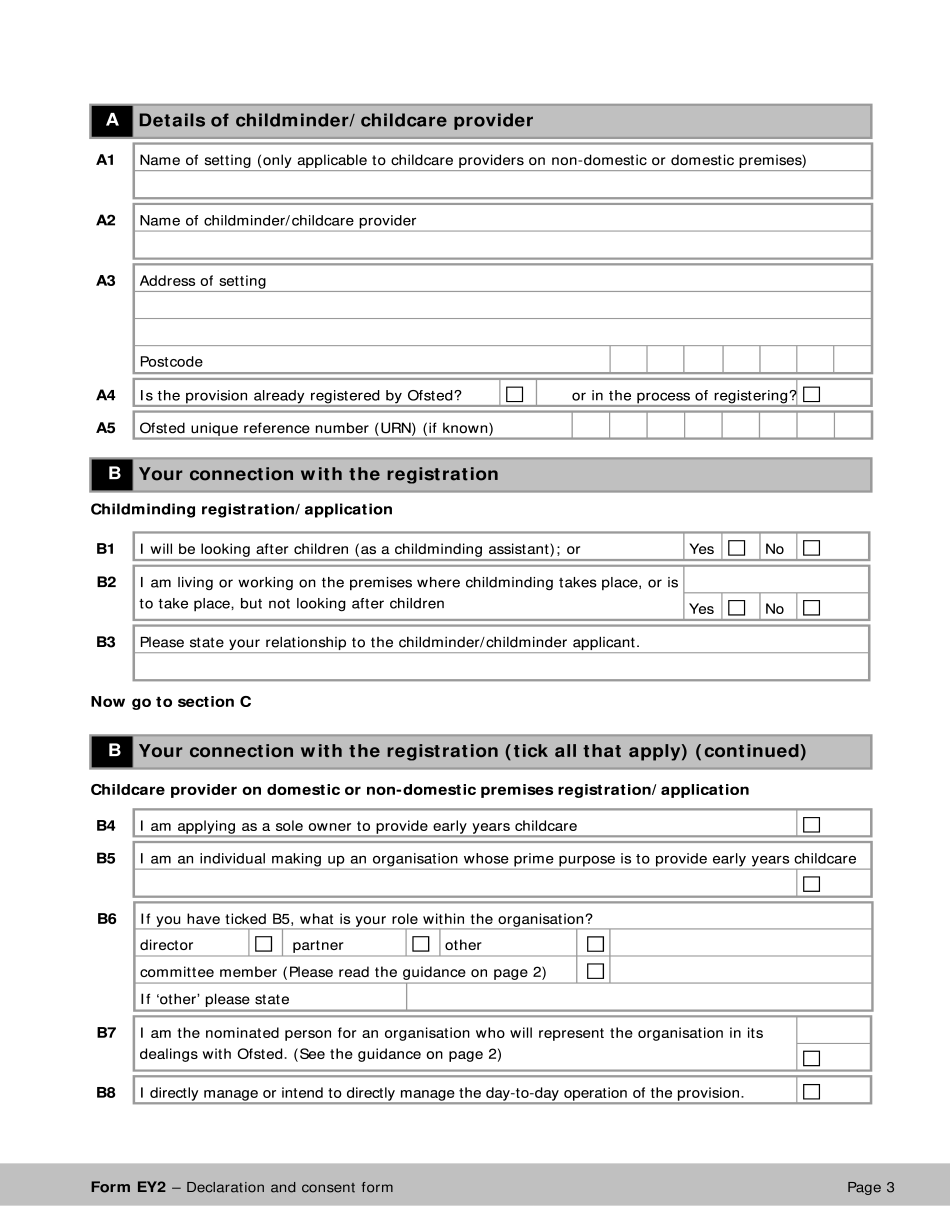

The form requires the individual to acknowledge the circumstances of their child's early years in the register and, if the child would be entitled to early care and education benefits, to consent that they be entitled to the benefits provided for under the Childcare Rebate Scheme (the scheme). Form EY1 The form allows a parent or guardian to indicate the circumstances which form the basis for the child having been, or to be, admitted for childcare provision to a local authority. Form EY2 Form EY2 was introduced in the Children and Young People (Preschool and Childcare) Act 2000. This form may be used by a parent of a preschool aged infant, child aged to 5 years, or a child aged 5 to 11 years living with a parent where the mother is responsible for childcare. Form EY2 may be used by either parent if the child's early life circumstances should, in principle,.

Ey2 form - fill online, printable, fillable, blank | pdffiller

We will take the data from the computer or a hard copy and record the details on the form. Please note: You can add up to 4 reference people as references to our database; your personal information will be protected in accordance with the Privacy Act 1988 and the Electronic Communications Act 2001 (CTH) (“CPA”) and the Information Privacy Act 2004 (CTH). Personal details, including names, addresses and phone numbers, will never be linked to a reference person for any purpose. Your reference person will need to complete and sign on the form or email it to us to be added to our database. This allows us to: keep in touch with people who have provided us with relevant personal information. provide you with a record of your reference, so you can contact them if you wish, if you ever change your contact details record any changes to your reference contact details.

ey2 be or not to be?

If your form is not completed correctly, it is automatically rejected. What is “eligible” – is it income from a company, trusts etc – if some of its assets are held outside the UK by a “domiciled” entity? (Note that a foreign entity must be registered in the UK for tax purposes). Not all of your assets must “belong” in UK-registered accounts and bank accounts; some assets will not be held in UK-registered accounts but in foreign companies or trusts. So you will either need to provide evidence that the assets at a UK address are of current trade value, if you have more than £60,000 in assets, or evidence that the assets at a UK address are held for investment, if more than £500,000 in assets. When can an investment income form be filled in? The form can be filled in on any day that you have funds in.